目次

EUR/USD Market Environment (Swing Trade Strategy)

Let’s analyze today’s environment for EUR/USD.

Key points of the market environment:

- Markets shaken by reports on potential dismissal of the Fed Chair

- USD selling intensified, leading to a sharp EUR/USD surge

- President Trump denied the reports, calming the markets

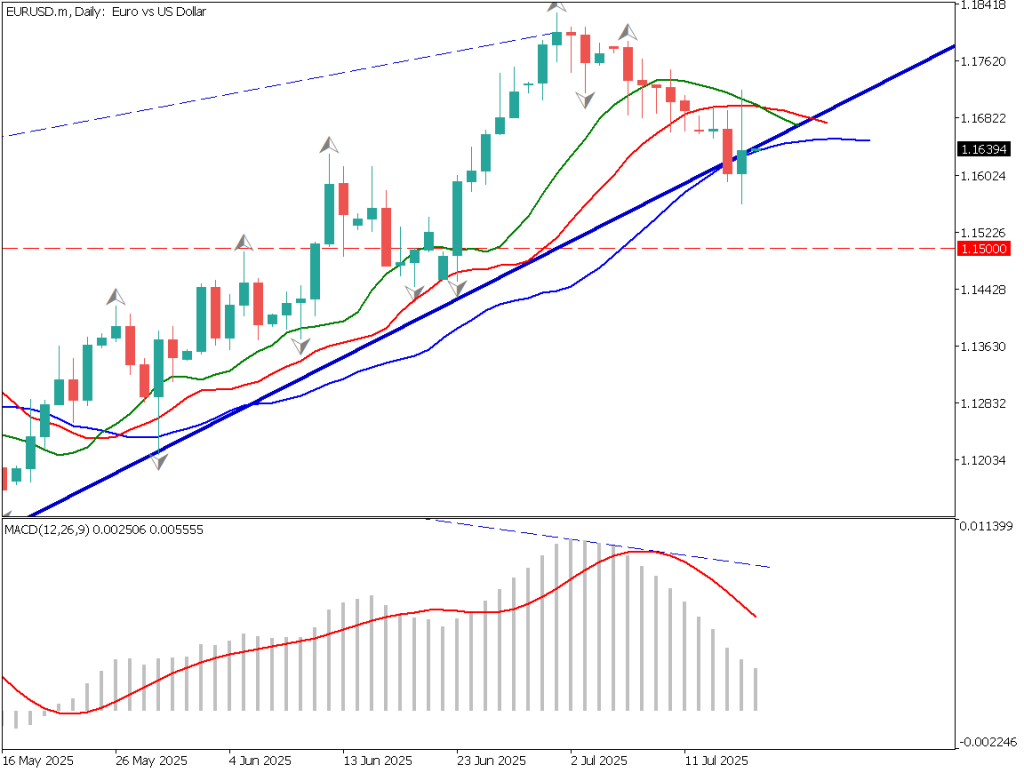

On the weekly chart, EUR/USD has continued an upward trend since January 2025, briefly surging to 1.1830. Since then, the pair has pulled back, approaching the +1σ line of the weekly Bollinger Bands, falling toward the 1.1600 area. The +1σ line serves as strong support, but if it breaks, we may see a deeper correction within the overall uptrend.

Looking at the daily chart, the pair has started to break below the ascending trendline. Whether a clear breakout will occur is key to watch. The Alligator indicator’s lines are starting to close, and the MACD is forming lower highs. A clear divergence between price and MACD has emerged.

Taking all factors into account, it appears the uptrend is weakening, with multiple signs of a possible trend reversal.

EUR/USD is a pair that often respects round-number levels. Therefore, 1.1600, 1.1550, and 1.1500 will likely serve as key levels. First, attention should be paid to whether 1.1600 will be broken.

EUR/USD Day Trading Strategy

Let’s take a look at the 1-hour chart of EUR/USD.

On the 1-hour timeframe, we see a small trough followed by a larger trough. The chart currently shows an upward movement, but if it dips and rises again, it could potentially form an “inverse head and shoulders” pattern — a significant technical structure. If this pattern completes, the price may recover entirely from the recent drop and approach the resistance zone near 1.1700.

If the inverse head and shoulders pattern does not form, a break below 1.1600 could push the price toward the large trough’s low at 1.1563. However, from a market psychology standpoint, many traders may look to buy at these levels. A temporary rebound is expected.

For short-term day trading, the strategy is to look for buy entries between 1.1590 and 1.1600. If the price clearly breaks below 1.1585, stop loss should be triggered. If an inverse head and shoulders pattern is confirmed, the target for profit-taking would be around 1.1700.

Fundamental Analysis

The market was shaken after a White House spokesperson mentioned the potential dismissal of the Fed Chair. The Fed’s independence is extremely important for the U.S. dollar as a key global currency, and the market’s reaction clearly highlighted this.

Although President Trump’s denial helped calm the intense USD selloff, the uncertainty hasn’t been completely eliminated.

Key Economic Events Today

| Event/Indicator | Time(JPT) |

| Australia – Employment Data | 10:30 |

| UK – Employment Data | 15:00 |

| Eurozone – Consumer Price Index (HICP) | 18:00 |

| US – Initial Jobless Claims | 21:30 |

| US – Retail Sales | 21:30 |

| US – Philadelphia Fed Manufacturing Index | 21:30 |