What was the result of the Japan-U.S. tariff negotiations?

- Market liberalization for Japanese agricultural products and automobiles

- Reciprocal tariffs on Japan set at 15%

- $580 billion (approx. ¥81 trillion) in additional investment toward the U.S.

In the latest Japan-U.S. tariff negotiations, Japan avoided the “25% tariff hike risk” and reached a relatively moderate agreement of 15% tariffs. The deal includes a 50% reduction in tariffs on automobiles and auto parts, and retention of tariffs on agricultural products.

A large-scale investment plan toward the U.S. and explicit economic security cooperation have been outlined, with the agreement widely regarded as a “historic win-win deal.” President Trump declared it “the biggest deal ever” on his social media.

The Nikkei 225 surged past 41,000, with many stocks posting sharp gains. Automotive stocks, which had been under close scrutiny for tariff impact, rallied significantly—Toyota Motor surged more than 12%.

Nikkei 225 Market Environment Analysis

The Nikkei 225 has surged significantly. After the tariff deal was posted last night, the market opened with strong buying momentum. The index broke above the recent high of 40,600, reaching into the 41,000 range. Previously stuck in a range as the market awaited negotiation outcomes, strong buying pressure emerged after the deal’s announcement.

In this scenario, imagining an “N-shaped” pattern helps estimate a target price. Based on the N-wave theory, the target level is around 41,900. The all-time high of the Nikkei 225 is 42,985, and the focus now turns to whether it can break this record.

USDJPY Day Trading Strategy

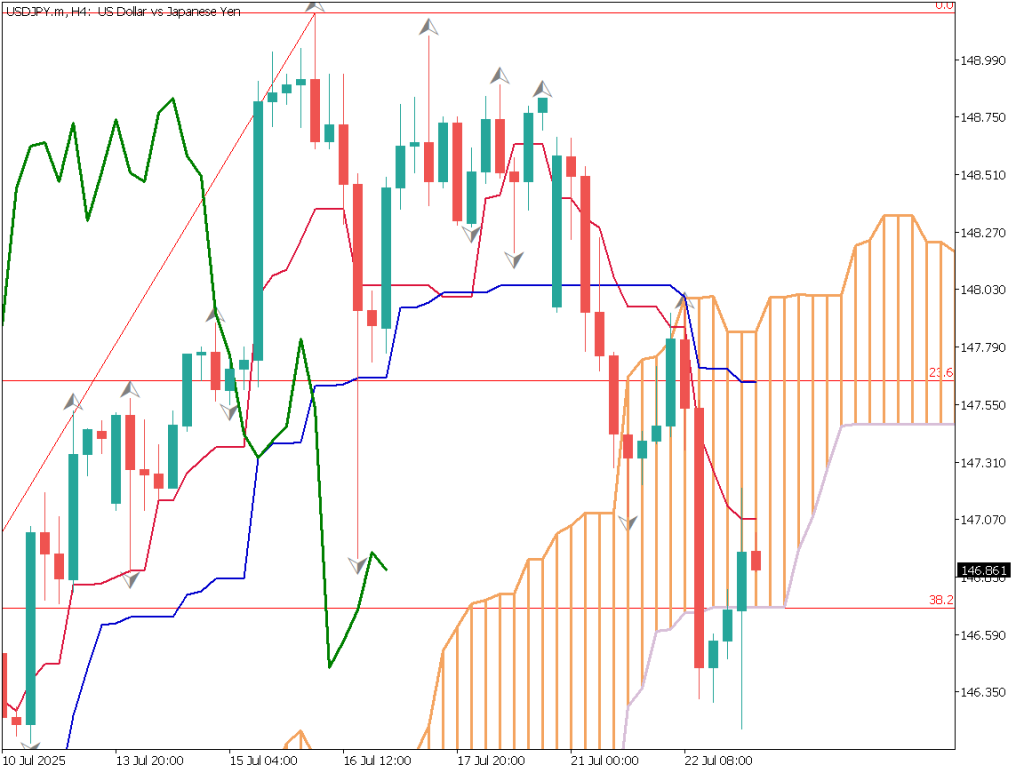

USD/JPY Trade Strategy (4H Chart)

Based on the Nikkei 225 movement, we consider swing and day trading strategies for USD/JPY. The pair had been rising to around 149 yen, but broke downward out of its range following the tariff deal announcement, dropping to the low 146 range. The 38.2% Fibonacci retracement level is key here, overlapping with the lower limit of the Ichimoku cloud (Leading Span B), serving as a support zone.

With news of the Ishiba administration’s resignation by the end of August and concerns about expanded fiscal spending, further yen depreciation pressure is anticipated. As long as the price doesn’t clearly break below the cloud, buying on dips is preferred.

Swing Trade Strategy:

- Market order to buy

- Medium-to-long-term target around 148 yen

- Stop loss if price falls below 146 yen

Day Trade Strategy:

- Buy limit order near mid-146 yen

- Take profit at 147.60 yen

Stop loss below 146.35 yen

Key Economic Events Today

| Event/Indicator | Time(JPT) |

| U.S. Existing Home Sales | 23:00 |

| Eurozone Consumer Confidence Index | 23:00 |